The Power of Starting Young

It is always exciting to see people in their twenties beginning to save for retirement. They are making life so much easier on...

The Power of Starting Young

It is always exciting to see people in their twenties beginning to save for retirement. They are making life so much easier on...

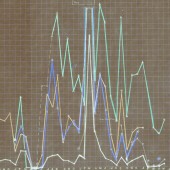

What is Arbitrage? Arbitrage is the practice of taking advantage of a price difference between two or more markets: striking a combination of matching deals that capitalize upon the imbalance, the profit being the difference between the market prices. Example: In the 19th century, the Rothschilds would buy gold in London one day and sell it […]