What is a 1031 Exchange?

A 1031 exchange, also known as a like-kind exchange, is a provision in the IRS code that currently allows real estate investors to defer paying capital gains taxes on an investment property when sold, as long as another similar property is purchased with the profit gained.

Details

This only applies to investment or business properties, not personal residences.

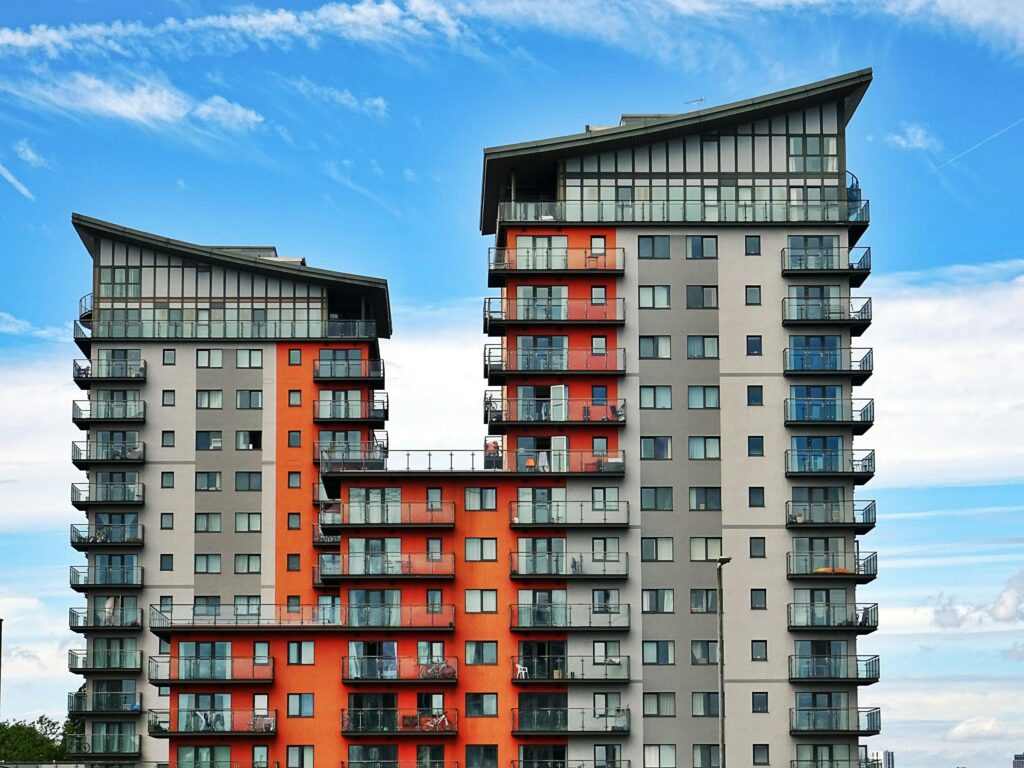

Both properties, the one sold and the one bought, must be like-kind, meaning they’re of the same nature. real estate for real estate, though they can be very different in form – a warehouse for an apartment building.

This technique can be a way to keep taxes to a minimum when transacting in certain real estate ventures.

Let’s talk about it.

-Zac