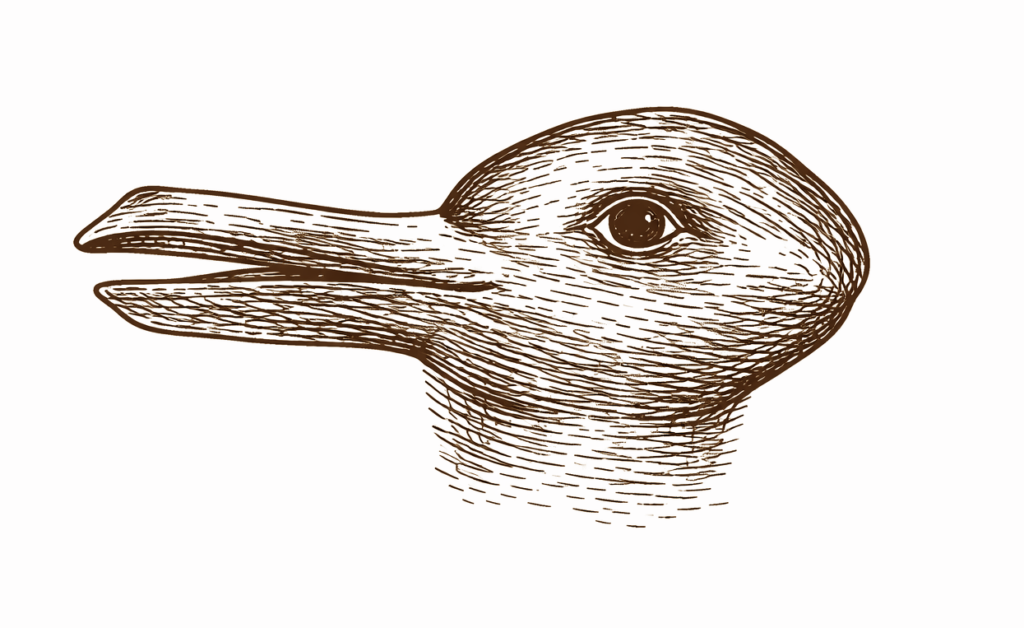

An Optical Illusion Could Teach Us About Value Traps

The classic duck or rabbit illusion seems straightforward. Some people see a duck while others see a rabbit. With a small shift in perspective, the image changes entirely.

Investment decisions can work in a similar way.

When “Cheap” Isn’t

Is a stock attractively priced or is it fundamentally challenged? Is a low earnings multiple an opportunity, or a cautionary signal?

A company trading at a low price compared to it’s earnings can look compelling compared to other available opportunities. The first reaction may be to assume the stock is undervalued and therefore a good investment opportunity.

Sometimes, however, a low price to earnings ratio indicates deeper issues such as slowing growth or eroding advantages. In such cases, the stock isn’t necessarily cheap. It may just be a bad investment in a struggling company. This is a value trap.

Earnings Multiples Tell a Story, But Are They Fact or Fiction?

An earnings multiple represents expectations about a company’s future growth prospects and financial strength.

Two companies can trade at similar multiples and still be very different investment opportunities. One may be a strong business experiencing temporary setbacks. The other may be facing a long-term decline. On the surface they look similar. With additional research, they may be completely different stories.

Avoiding value traps requires looking beyond only valuation metrics and digging deeper into the story

- Are earnings under temporary pressure, or is the business fundamentally impaired?

- Is the business gaining or losing market share?

- What would need to change for the valuation to increase?

- Do you actually like the business or are you buying it because you think it’s inexpensive?

A Duck or a Rabbit?

First impressions can be misleading.

Sometimes a low-priced stock represents genuine opportunity.

Sometimes it is simply a rabbit posing as a duck.

Now, whether a rabbit is a better investment than a duck… You will have to call the office to find out.

-Zac

Inspiration from Matt T