The Power of Starting Young

It is always exciting to see people in their twenties beginning to save for retirement. They are making life so much easier on themselves by harnessing the power of compound interest.

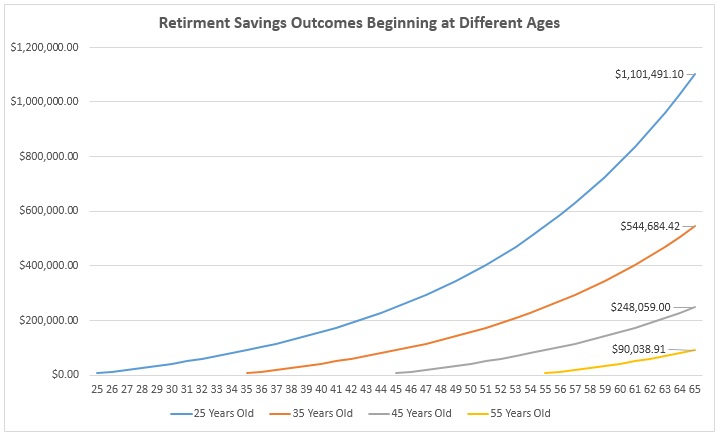

The following chart assumes a theoretical 6.5% annual investment return, a $5,500 annual contribution to a Roth IRA, and a retirement age of 65.

Using the assumptions in this chart, we can see that by starting to save at age 25, one could theoretically amass $1,101,491.10 by retirement age. That is $556,807 more than they may have saved had they begun saving just 10 years later at age 35.

It is incredible what a positive impact beginning to save at a young age can have on one’s long-term financial health in retirement. Save regularly, invest prudently, and time may take care of the rest.

The information in this post was compiled by S. Zachary Fineberg, Managing Member of Fineberg Wealth Management, LLC, a registered investment advisor located in Ann Arbor, MI. If you would like to schedule a consultation to discuss how Fineberg Wealth Management can help you reach your long-term financial goals, please contact us by email or call (734) 230-7900.