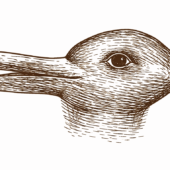

An Optical Illusion Could Teach Us About Value Traps

The classic duck or rabbit illusion seems straightforward. Some people see a duck while others see a rabbit. With a small shift in...

An Optical Illusion Could Teach Us About Value Traps

The classic duck or rabbit illusion seems straightforward. Some people see a duck while others see a rabbit. With a small shift in...

A Charitable Remainder Trust is a type of instrument that allows a donor to transfer assets to a trust, receive income for a specified period, and then have the remaining assets go to a charitable cause. It is a tax-exempt entity that offers a way to support charitable causes while also providing income to the […]